How to Invest in Nvidia Stock: Complete Guide

Nvidia is leading the charge in artificial intelligence, machine learning, and graphics processing. This guide will explore how to invest in Nvidia stock. We’ll look at the company’s business model, market position, financial health, and strategic investment considerations.

Nvidia’s GPU technology has changed the gaming and computing worlds. It’s a top choice for those looking to invest in the fast-growing semiconductor and GPU markets. By understanding Nvidia’s main revenue sources, market leadership, and competition, investors can make smart choices.

Key Takeaways

- Nvidia is a global leader in GPU technology, powering advancements in AI, machine learning, and gaming

- The company’s diverse revenue streams, including gaming, data centers, and professional visualization, provide a solid foundation for growth

- Nvidia’s market dominance and competitive advantages make it an attractive investment opportunity for investors seeking exposure to the semiconductor industry

- Careful analysis of Nvidia’s financial performance, valuation, and risk factors is crucial for making informed investment decisions

- Prudent investment strategies, such as dollar-cost averaging and portfolio diversification, can help mitigate risks and maximize long-term returns

Understanding Nvidia’s Business Model and Market Position

Nvidia is a top name in the semiconductor world. It excels in graphics processing unit (GPU) technology. The company’s success comes from its many revenue streams and strong market position in GPUs.

Core Revenue Streams and Products

Nvidia makes most of its money from GPUs. These are used in gaming, professional work, data centers, and cars. The GeForce, Quadro, and Tesla lines are key products. They help Nvidia keep a big GPU market share and lead the industry.

Market Leadership in GPU Technology

Nvidia leads the GPU market thanks to its innovation. It offers powerful, energy-saving GPUs for many industries. Its Nvidia revenue streams grow because it stays ahead of rivals with top GPU products.

Competition Analysis

Nvidia faces competition from AMD and Intel in the GPU market. But Nvidia’s tech skills, brand, and strong ecosystem keep it ahead. It holds its top spot despite rival challenges.

| Metric | Nvidia | AMD | Intel |

|---|---|---|---|

| GPU Market Share | 79% | 20% | 1% |

| Revenue (2022) | $26.9 billion | $23.6 billion | $63.1 billion |

| Net Income Margin | 39.8% | 22.2% | 32.6% |

“Nvidia has been at the forefront of GPU development, offering powerful and energy-efficient solutions that cater to the growing demands of various industries.”

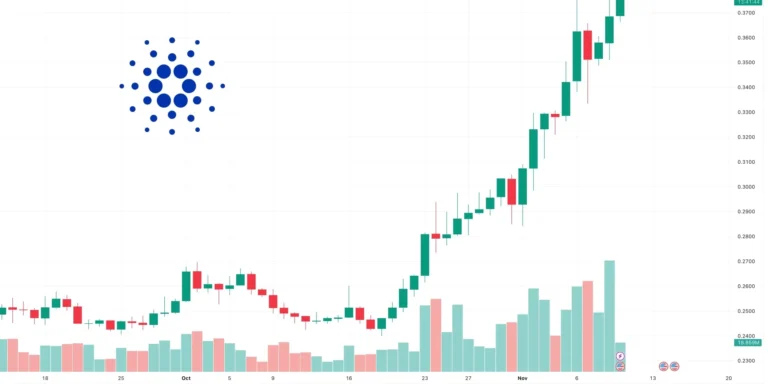

Historical Performance of Nvidia Stock

Nvidia’s stock, trading under the ticker symbol NVDA, has shown amazing growth over time. Looking at the Nvidia stock price history shows the company’s strong performance. It highlights Nvidia’s leading role in the semiconductor industry.

Since its IPO in 1999, Nvidia’s stock has seen big gains. This growth shows the company’s tech progress and market dominance. In the early 2000s, the stock was around $20. But as Nvidia grew in the GPU market, its NVDA stock performance really took off.

A major event for Nvidia’s stock was the cryptocurrency mining boom in the mid-2010s. The demand for GPUs for mining pushed Nvidia’s stock to over $280 in 2018.

Nvidia has kept showing long-term stock growth even after the cryptocurrency market’s ups and downs. The company has grown into data centers, gaming, and new tech areas. Its strong finances, new products, and partnerships have boosted its stock over the years.

For investors thinking about Nvidia, knowing its stock history is key. It helps understand its growth chances and what has shaped its stock price.

Analyzing Nvidia’s Financial Health

Investors need to look closely at Nvidia’s financial statements. This helps understand the company’s health and growth chances. We’ll check Nvidia’s revenue growth, profit margins, balance sheet, and cash flow. This analysis is key for making smart investment choices.

Revenue Growth and Profit Margins

Nvidia’s revenue has grown fast, thanks to its advanced GPU technology. The company has seen double-digit revenue increases year after year. This shows Nvidia’s skill in tapping into new markets and trends. Its profit margins are also high, showing strong pricing and efficiency.

Balance Sheet Strength

Nvidia’s balance sheet shows the company’s financial health and smart management. It has a lot of cash, ready for future growth or market challenges. Nvidia’s debt is also well-managed, supporting the business’s financial base.

Cash Flow Analysis

Nvidia’s cash flow is another key area to examine. The company makes positive operating cash flow, which it uses for research, product expansion, and shareholder value. Looking at Nvidia’s cash flow helps investors see its financial flexibility and future stability.

| Metric | 2021 | 2020 | 2019 |

|---|---|---|---|

| Revenue (in billions) | $16.68 | $10.92 | $11.72 |

| Profit Margin | 35.8% | 27.7% | 21.5% |

| Cash and Cash Equivalents (in billions) | $11.56 | $10.92 | $8.74 |

| Debt (in billions) | $0.98 | $1.98 | $1.98 |

| Operating Cash Flow (in billions) | $5.54 | $3.70 | $3.21 |

By studying Nvidia’s financial statements, investors can learn a lot. They can see how well the company is doing and its chances for future growth.

How to Buy Nvidia Stock Through Brokers

Investing in Nvidia stock is now more popular than ever. It’s a great way to get into the fast-growing semiconductor industry. To buy Nvidia shares, you need to open an account with an online broker or trading platform. It’s easy and can be done in a few steps.

Start by looking at different online brokers to find the right one for you. Popular brokers like Fidelity, Charles Schwab, and E*TRADE are great for buying Nvidia stock and more. After picking a broker, you can start the account opening process. This involves giving personal info, verifying your identity, and adding money to your account.

- Choose an online broker or stock trading platform that offers access to the Nasdaq exchange where Nvidia is listed.

- Complete the account opening process by submitting the required personal and financial information.

- Fund your account using your preferred payment method, such as a bank transfer or debit card.

- Place your order to buy Nvidia shares, selecting the appropriate order type (market, limit, or stop order) based on your investment strategy.

- Monitor your Nvidia stock position and adjust your investment as needed, considering factors like market conditions and Nvidia’s performance.

Remember, investing in any stock, including Nvidia, comes with risks. It’s key to do your homework, spread out your investments, and talk to a financial advisor if you need to. By following these steps, you can start investing in Nvidia stock with confidence through trusted online brokers.

Risk Factors When Investing in Nvidia Stock

Investing in Nvidia stock has its risks. As a top player in semiconductors, Nvidia faces competition and regulatory hurdles. Knowing these risks helps investors make better choices.

Market Competition Risks

Nvidia competes with AMD and Intel in the GPU and AI markets. If rivals innovate and market well, Nvidia’s lead could slip. This could hurt its stock price.

Semiconductor Industry Cycles

The semiconductor market goes through ups and downs. Nvidia investment risks grow during these cycles. Investors should watch the semiconductor market volatility closely.

Regulatory Challenges

The tech sector, including semiconductors, faces many regulations. Changes in these rules can greatly affect Nvidia’s business. This, in turn, can impact its stock.

To invest in Nvidia wisely, one must understand the company’s competition, the industry’s ups and downs, and the rules it must follow. This knowledge helps investors manage their Nvidia investment risks well.

“Investing in Nvidia stock is not without its challenges, but understanding and managing these risks can be the key to long-term success.”

Nvidia Stock Valuation Methods

Investing in Nvidia stock requires understanding its valuation. There are several ways to figure out if the stock is overvalued or undervalued. Let’s look at some common methods.

Price-to-Earnings (P/E) Ratio

The price-to-earnings ratio is a key metric for Nvidia’s stock. It compares the stock price to earnings per share. This helps investors see if the stock is more expensive or cheaper than others.

Discounted Cash Flow (DCF) Analysis

The discounted cash flow analysis is a detailed method. It calculates Nvidia’s stock value based on future cash flows. It considers growth, cost of capital, and more to find a fair stock price.

Industry Comparisons

Comparing Nvidia to its peers is also useful. Investors can look at Nvidia stock valuation, price-to-earnings ratio, and other ratios. This helps see how Nvidia compares to others in the industry.

Using these methods, investors can better understand Nvidia’s stock. This knowledge helps them decide if investing in Nvidia is a good choice.

Investment Strategies for Long-term Growth

Investing in Nvidia stock can be a smart move for the long haul. Two good ways to think about it are using the dollar-cost averaging method and making Nvidia a key part of your portfolio.

Dollar-Cost Averaging Approach

Dollar-cost averaging means setting aside a fixed amount of money at regular times, no matter the stock price. It helps you deal with market ups and downs. By doing this, you buy more shares when prices are low and fewer when they’re high. This way, you end up paying less on average for each share.

Portfolio Allocation Guidelines

- Put 5-10% of your total portfolio into Nvidia long-term investment

- Spread your investments across different areas and types to lower risk

- Check and adjust your portfolio now and then to keep it balanced

Using these strategies can help you create a solid investment plan. It takes advantage of Nvidia’s growth potential while keeping risk in check through smart portfolio management.

Technical Analysis of Nvidia Stock

Exploring Nvidia stock through technical analysis is key for investors. This method uncovers trading patterns and trends not seen in basic company data. It’s a powerful tool for spotting investment opportunities.

Looking at technical indicators is crucial. Moving averages show the stock’s momentum and possible support or resistance. Oscillators like the Relative Strength Index (RSI) help spot when the stock is overbought or oversold. This guides when to buy or sell.

Studying chart patterns is also vital. Patterns like head and shoulders, double tops or bottoms, and triangles signal price movements. They help investors make smart decisions about their Nvidia stock.

Combining knowledge of Nvidia’s fundamentals with technical analysis is essential. It helps investors craft a solid strategy. This strategy boosts their success in the fast-changing semiconductor market.

Latest Developments and Future Prospects

Nvidia leads in the semiconductor world, especially in AI and machine learning. As trends change, Nvidia stays ahead, working on new technologies to shape the future.

AI and Machine Learning Initiatives

Nvidia is all in on AI and machine learning. Its GPUs power many AI tasks, like understanding language and seeing images. With tools like NVIDIA Jetson and DGX, Nvidia helps businesses and researchers explore AI’s limits.

Expansion Plans and New Markets

Nvidia is looking beyond its main business. It’s made big moves in cars, helping with self-driving tech and safety features. It’s also diving into healthcare, using AI for medical images and finding new drugs.

Nvidia’s future looks bright. It’s innovating, expanding, and focusing on AI and machine learning. This will help it meet growing demand for advanced semiconductors and keep its leading role in the industry.

“Nvidia’s dedication to innovation and its ability to anticipate market trends have been the driving forces behind its remarkable growth and success in the semiconductor industry.”

Conclusion

Investing in Nvidia stock can be a good choice for long-term growth. The company leads in the semiconductor market and innovates in AI and machine learning. Its strong revenue growth and profit margins show its potential for investors.

Nvidia stock comes with risks like market competition and industry cycles. But, the company’s success and future look promising. This makes it a good pick for those interested in the semiconductor sector.

Investing in Nvidia should be a careful decision. It’s important to look at the company’s basics, market outlook, and fit with your investment goals. By doing this, you can make the most of Nvidia’s stock investment summary, semiconductor market outlook, and long-term growth potential.

FAQ

What are Nvidia’s core revenue streams and products?

Nvidia makes most of its money from graphics processing units (GPUs). These are used in gaming, data centers, and cars. Their main products are GeForce GPUs for gaming, Quadro for work, and CUDA for computing.

How does Nvidia maintain its market leadership in GPU technology?

Nvidia stays ahead by always innovating and improving its technology. Their GPUs, like Ampere and Turing, are top in performance and efficiency. This keeps them leading in the market.

What are the key competitors in the semiconductor industry that Nvidia faces?

Nvidia faces competition from AMD, Intel, and Qualcomm. These companies offer similar products, making the market competitive.

How has Nvidia’s stock performed historically?

Nvidia’s stock has grown a lot over time. It went from about $10 in the early 2000s to over $600 in 2021. This growth is due to the company’s success and technological advancements.

What are the key financial metrics that investors should analyze when evaluating Nvidia’s financial health?

Investors should look at Nvidia’s revenue, profit margins, and cash flow. These show how profitable and stable the company is financially.

How can investors purchase Nvidia stock through brokers?

Investors can buy Nvidia stock through online brokers like Fidelity or Charles Schwab. First, open an account, fund it, and then buy Nvidia shares through the broker’s platform.

What are some of the key risk factors associated with investing in Nvidia stock?

Risks include competition, industry cycles, and regulations. Knowing these can help investors understand the potential challenges.

How can investors value Nvidia stock using different valuation methods?

Investors can use methods like price-to-earnings ratio or discounted cash flow to value Nvidia stock. These help decide if the stock is a good buy or sell.

What are some long-term investment strategies for Nvidia stock?

Strategies like dollar-cost averaging and diversifying can work for Nvidia stock. Investors should consider their risk level and investment time frame.

What are some of the latest developments and future prospects for Nvidia?

Nvidia is focusing on artificial intelligence and machine learning. These areas have big growth potential in data centers, cars, and more. The company is also exploring new markets and technologies.