Crypto Season 2025: What to Expect in Digital Assets

As we look towards 2025, the world of cryptocurrency is set for big changes. Over the last ten years, digital assets have grown a lot. The next five years will likely be even more thrilling.

Big names like Bitcoin and Ethereum will keep growing. New DeFi and NFTs will also appear. This means a lot of new chances for digital assets.

In this deep dive, we explore what’s coming for the crypto market in 2025. We’ll look at the current state of the industry. We’ll also check out the tech advancements that are changing digital assets. Our goal is to give you a clear view of what’s next.

Key Takeaways

- Cryptocurrency market capitalization and adoption rates are expected to continue their upward trajectory, with increased institutional and mainstream adoption.

- Technological innovations, such as layer 2 solutions, cross-chain interoperability, and smart contract advancements, will enhance the functionality and scalability of digital assets.

- Regulatory frameworks are anticipated to evolve, providing greater clarity and stability for the cryptocurrency industry.

- The environmental impact of crypto mining will remain a key focus, with the adoption of green mining solutions and carbon offset initiatives.

- DeFi and NFT markets are poised for significant growth, offering new investment opportunities and use cases for digital assets.

The Current State of Cryptocurrency Markets

The crypto market has grown a lot in recent years. It’s now bigger than ever before. Understanding this growth is key to seeing where it’s headed.

Market Capitalization Trends

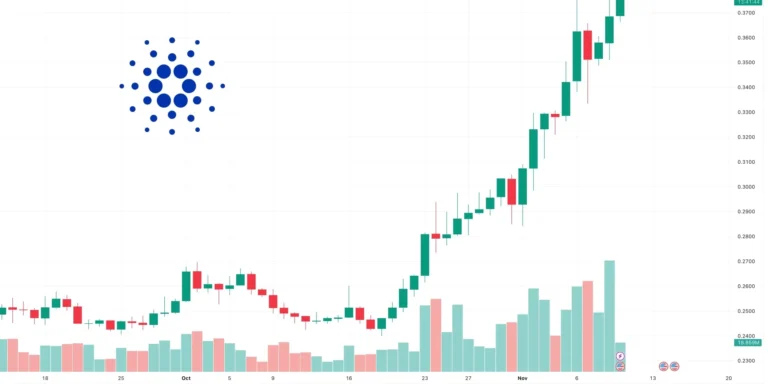

The total crypto market value has hit over $2 trillion in 2021. Bitcoin and Ethereum are still the biggest names. But, new players like Solana, Cardano, and Polkadot are changing the game.

Key Players and Market Leaders

Some cryptocurrencies stand out as leaders. Bitcoin is the pioneer, and Ethereum is the top platform for apps and smart contracts. Other big names like Litecoin, Binance Coin, and Ripple have found their places in the Ethereum ecosystem.

Global Adoption Rates

- More people and businesses are using cryptocurrencies.

- The United States, United Kingdom, and Australia are leading in crypto use. But, Asia and Latin America are catching up fast.

- The COVID-19 pandemic, the push for financial inclusion, and DeFi interest have boosted crypto acceptance worldwide.

The crypto market is getting more diverse and widely accepted. New leaders are emerging. The future looks bright, with new tech and rules shaping the industry.

| Metric | 2021 | 2022 | 2023 |

| Crypto Market Cap | $2.2 Trillion | $1.8 Trillion | $2.5 Trillion |

| Bitcoin Dominance | 42% | 39% | 41% |

| Ethereum Ecosystem | 20% | 23% | 25% |

| Altcoin Performance | 38% | 35% | 34% |

Crypto Season 2025: Predicted Market Cycles

The cryptocurrency market is getting ready for a wild ride in 2025. The Bitcoin halving event and the ups and downs of bull and bear markets will define the future of digital assets.

The Bitcoin halving happens every four years and can start a bull market. It makes Bitcoin scarcer, which increases demand. Experts think the 2024 halving could lead to a big increase in crypto volatility and a new bull market.

But, growth isn’t always steady. After bull markets, prices often drop in bear markets. These drops can be caused by many things, like new rules, security issues, or economic worries. As the crypto world grows, it’s important to watch for both the highs and lows of the Crypto Season 2025.

“The cryptocurrency market is a dynamic and unpredictable landscape, with the potential for both significant gains and substantial losses. Investors must exercise caution and diversify their portfolios to navigate the Crypto Season 2025 effectively.”

Knowing the past and what’s coming can help investors prepare for 2025. The ongoing crypto volatility will keep changing the digital asset world. Staying informed and flexible will be crucial for success in the Crypto Season 2025.

Institutional Investment Landscape in 2025

The cryptocurrency market is growing, and big investors are getting involved. Banks, companies, and pension funds will play a big role. They will help shape the future of digital assets.

Corporate Treasury Strategies

Big companies are already using crypto ETFs and corporate Bitcoin holdings in their money management. This trend will grow, with more companies putting money into digital assets. This will make the market more stable and attractive to more companies.

Investment Bank Integration

Big Wall Street players will get more involved in crypto. They will offer crypto ETFs, custody services, and trading desks. This will connect traditional finance with the crypto world.

Pension Fund Participation

Pension funds will also join the crypto market by 2025. As more big investors get into crypto, these funds will put some of their money into digital currencies. They want to grow their portfolios and take advantage of crypto’s growth.

More big investors in crypto will change the market. It will become more stable, liquid, and widely accepted by 2025.

Regulatory Framework Evolution

The world of cryptocurrency is growing, and so is the need for clear rules. By 2025, we’ll see big changes in how digital assets are regulated. Governments are working hard to balance innovation with safety and stability.

Expect to see stricter crypto regulations in big countries. The U.S. Securities and Exchange Commission (SEC) and the Financial Action Task Force (FATF) will update their rules. These changes will help deal with the special risks of digital assets.

New rules will try to help the crypto markets grow while keeping things safe. They’ll focus on protecting investors, fighting money laundering, and blending digital assets with traditional finance.

| Key Regulatory Developments | Potential Impact |

| Expanded SEC oversight of cryptocurrencies | Increased transparency and investor protection, but potentially slower innovation |

| FATF updates to AML/CFT guidelines for virtual asset service providers | Stricter compliance requirements for crypto businesses, improving global compliance |

| Harmonization of crypto regulations across jurisdictions | Reduced regulatory fragmentation and more consistent standards for the industry |

As rules change, being flexible and talking to lawmakers will be key. This will help crypto companies and investors succeed in the new digital world.

Technological Advancements Shaping Digital Assets

The world of cryptocurrency is changing fast. New technologies are coming that will change how we use digital assets. These changes will make the crypto world better in 2025 and beyond.

Layer 2 Solutions

Blockchain networks face a big problem: they can’t handle many transactions at once. Layer 2 solutions like the Lightning Network and Polygon are here to help. They work on top of the main blockchain, making transactions faster and cheaper.

Cross-chain Interoperability

The growth of Web3 infrastructure has led to new ways for blockchains to talk to each other. This interoperability is key for DeFi protocols to work better together. It helps make cryptocurrency privacy solutions stronger and more connected.

Smart Contract Innovation

New advancements in blockchain scalability and cross-chain tech are also boosting smart contracts. Next-gen smart contracts will be more secure and flexible. This will let us build more complex and powerful DeFi protocols and Web3 infrastructure.

These new technologies will open up exciting possibilities for the crypto world. They will help users, developers, and businesses use digital assets to their fullest potential in the future.

DeFi and NFT Market Projections

The world of cryptocurrency is changing fast. Two big areas are getting ready to shine: decentralized finance (DeFi) and non-fungible tokens (NFTs). These blockchain tech innovations will change how we deal with digital stuff and the metaverse.

Experts say decentralized finance growth will speed up a lot. They think the total value in DeFi will hit over $1 trillion by 2025. This growth will come from more people using DeFi for loans, trades, and other financial stuff. It will give users more control and clearness over their digital assets.

The NFT use cases are also set to grow and get more varied. NFTs are now used for digital art, collectibles, gaming, and even real estate. By 2025, the NFT market could hit $80 billion. This is because more people and companies see the worth in these special digital items.

The mix of DeFi and NFTs with the metaverse integration will open up new chances for both. As virtual worlds get more real and connected, the need for easy financial services and unique digital items will keep rising. This will help these digital worlds grow even more.

As the crypto world gets better, the mix of DeFi, NFTs, and the metaverse will change how we see and use digital value. It will start a new time of financial power and creative freedom.

Environmental Impact and Sustainable Crypto Mining

The crypto world is growing fast, but it’s facing a big problem: its environmental impact. But, there’s hope for a better future. By 2025, we’ll see more eco-friendly cryptos and green mining, making the crypto world more sustainable.

Green Mining Solutions

Green mining solutions are leading the way to a greener crypto world. These solutions aim to cut down energy use and carbon emissions. Some key green mining solutions include:

- Using solar, wind, and hydroelectric power to run mining rigs.

- Improving mining hardware and software to use less energy.

- Working together to build sustainable mining facilities.

Energy Consumption Metrics

As we move towards a greener future, tracking energy use is key. By 2025, we’ll see clearer reports on energy use in crypto networks. This will help everyone make better choices and understand the environmental impact of different cryptos.

Carbon Offset Initiatives

Carbon offset initiatives are becoming more popular to reduce mining’s environmental impact. These programs help miners and projects invest in green projects to balance out their emissions. This is a big step towards a carbon-neutral blockchain future.

The crypto world’s journey to being more eco-friendly is important. By 2025, we’ll see big steps in renewable energy mining and eco-friendly cryptocurrencies. The focus on green solutions, tracking energy use, and carbon offsetting will be crucial for a greener crypto future.

Conclusion

Looking ahead to 2025, the future of digital assets and blockchain technology is bright. Investors and users should get ready for a changing world. This world will bring both chances and hurdles.

It’s key to use smart crypto investment strategies and spread out your digital asset portfolio. The market’s ups and downs will be easier to handle this way. New tech like Layer 2 solutions and smart contracts will open up fresh opportunities.

The rules around crypto are still changing, but big money is starting to get involved. This includes companies, banks, and even pension funds. At the same time, making crypto mining green is a big focus. This will help the environment and make crypto more sustainable.