The Crypto Bull Run of 2024: Key Drivers, Opportunities, and Risks Ahead

There is a lot of enthusiasm surrounding the arrival of the Crypto Bull Run of 2024. The market is beginning to show signs of life after months of uncertainty, as evidenced by rising charts and a revived sense of hope. Regardless of your level of experience with cryptocurrency, now might be the best moment to keep a close eye on things because the next big wave of opportunity might be on the horizon.

1. The Rise of Digital Assets in 2024

The perception of cryptocurrency as a fringe investment is gradually beginning to change, and 2024 will be a significant turning point. What started out as a tech enthusiast niche market is rapidly developing into a respectable asset class with a large global following. Many investors are seeking to diversify as the conventional financial systems continue to exhibit symptoms of stress, and cryptocurrency is emerging as a compelling substitute. While more recent assets like Solana and Polkadot are gaining popularity among those searching for the next big opportunity, Bitcoin and Ethereum, which were initially regarded with suspicion, are now widely acknowledged as stores of value, much like gold.

Industry-wide adoption of blockchain technology is speeding up, which increases trust in cryptocurrencies even more. Crypto payments are currently being used by major corporations and countries.Digital currencies are becoming ingrained in our financial system, as evidenced by the fact that major corporations are now accepting cryptocurrency payments and that countries are investigating central bank digital currencies (CBDCs). Even while there are still legislative obstacles to overcome, nations like the US and EU are moving closer to establishing more precise crypto laws. A huge bullish run is being built up by this institutional effort.

The most intriguing aspect is how investor behavior is being impacted by this newfound understanding. Crypto’s reputation as a “wild bet” is waning. More people are starting to see it as a valid asset for their portfolios, including more conventional investors. Growing public interest, technical developments, and advantageous legislative changes might make 2024 a historic year for cryptocurrencies.

2. Key Factors Driving the 2024 Bull Run

A number of important elements are combining to support the 2024 cryptocurrency boom. First and foremost, the macroeconomic environment is getting better. Investors are looking for alternative assets to protect themselves from market volatility as global markets are gradually rebounding and inflation concerns are subsiding in some areas. Because of their decentralized structure, cryptocurrencies make an alluring hedge, particularly in light of the pressure that central banks’ monetary policies are placing on traditional fiat currencies.

The growing institutional interest is another motivating aspect. Well-known financial firms like JPMorgan and Goldman Sachs have started to provide services connected to cryptocurrencies, confirming the asset class and supplying market liquidity. This institutional adoption is crucial because it shows regular investors that cryptocurrency is a fundamental component of the changing financial landscape rather than merely a fad. The bull run has also been strengthened by the emergence of cryptocurrency ETFs and futures products, which have made it simpler for big investors to obtain market exposure.

Finally, there is a use case for cryptocurrency that goes beyond speculation thanks to the rapid advancement of blockchain applications and decentralized finance (DeFi). While blockchain-powered smart contracts are transforming sectors like supply chain management, healthcare, and even entertainment, DeFi protocols allow users to lend, borrow, and trade assets without depending on traditional institutions. Because of these developments, cryptocurrencies are becoming more useful in the real world and drawing in more investors who are interested in long-term gains rather than merely quick gains.

3. Bitcoin and Ethereum: The Dominant Players in 2024

In 2024, Bitcoin, the forerunner of the cryptocurrency space, is still at the forefront. Due to its limited supply—there will only ever be 21 million Bitcoin—it has become a highly sought-after asset during uncertain economic times. Bitcoin’s price has steadily increased as institutional investors continue to view it as “digital gold,” and more people are beginning to view it as a store of wealth rather than merely a speculative asset. Furthermore, the ongoing development of the Lightning Network and Bitcoin’s shift to a more energy-efficient proof-of-stake consensus mechanism through updates like Taproot are establishing the cryptocurrency as a more reliable and scalable asset.

In contrast, Ethereum has remained the preferred platform for smart contracts and decentralized apps (dApps). A major component of the Ethereum network’s value proposition in 2024 is the switch to Ethereum 2.0, which aims to improve scalability and reduce energy usage. Ethereum’s status as a key participant in the blockchain ecosystem is being cemented by its involvement in DeFi, NFTs, and Web3. Ethereum’s network effect increases as more developers and businesses build on it, increasing its value in tandem with Bitcoin.

These two giants are thriving, not merely getting by. Bitcoin and Ethereum remain the cornerstones of the cryptocurrency field as the market develops. Even though there are many promising new projects, it is evident that these two resources continue to be the main drivers of the bull run.Investors continue to flock to them, and their continued technological advancements are positioning them for even more growth in 2024.

4. Altcoins and the Potential for Explosive Growth

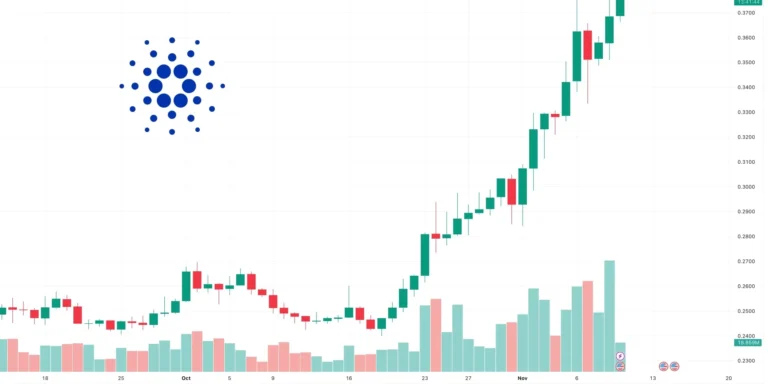

Even if Bitcoin and Ethereum are the most talked-about, investors seeking high-risk, high-reward investments can find a wealth of opportunities in the altcoin space. In 2024, cryptocurrencies like Solana, Polkadot, and Avalanche are becoming increasingly popular because of their distinct features and quicker, more scalable networks than Ethereum. A burgeoning ecosystem of new tokens is being created as a result of developers choosing to construct their decentralized applications on these alternative networks due to Ethereum’s ongoing fluctuations in gas fees.

Another noteworthy development for altcoins in 2024 is the appearance of sidechains and Layer 2 solutions. Initiatives like Arbitrum and Optimism aim to increase the scalability of current blockchain networks, resulting in quicker and less expensive transactions. Altcoins are finding new applications thanks to these technologies, and as they become more widely used, the value of their corresponding tokens is rising rapidly. As the cryptocurrency market develops, this pattern is probably going to continue as more and more investors diversify into altcoins.

Altcoins are gaining from new tokenomics and more community involvement in addition to technology breakthroughs. By encouraging users to keep and stake their tokens, several altcoins are establishing new economic models that incentivize sustained involvement. The wider market is taking notice of cryptocurrencies because they are providing additional avenues for investors to generate passive income, whether through governance tokens, staking rewards, or liquidity mining.

5. Navigating Risk in the 2024 Crypto Market

The 2024 cryptocurrency market is not an exception to the rule that big rewards are accompanied by inherent risk. Volatility is still a distinguishing feature of the market notwithstanding the excitement surrounding the bull run. Within hours, prices can fluctuate greatly, and the market may be significantly impacted by new laws, technical difficulties, or security concerns. Knowing the risks and how to reduce them is essential for anyone attempting to navigate this area.

One important tactic for controlling risk in cryptocurrency is diversification. Although Ethereum and Bitcoin offer stability, newer projects and altcoins may have greater room for expansion. Having a well-balanced portfolio is crucial, particularly if you’re new to the market. You can shield yourself from the worst of the volatility by sticking to long-term investments in well-known currencies while progressively investigating new ventures.

Monitoring market sentiment and world events is another strategy to reduce risk. News, whether it be favorable advancements in blockchain technology or unfavorable regulatory updates, frequently causes a significant reaction in cryptocurrency values. Reducing the probability of making hasty financial decisions and staying ahead of the market can be achieved by keeping yourself informed and modifying your approach accordingly. Being proactive, knowledgeable, and cautious will be just as crucial in 2024 as any trade you make.