Exploring Cardano’s Price: Key Factors, Trends, and Future Outlook

Cardano (ADA) is a cryptocurrency that has gained a lot of attention due to its distinctive use of blockchain technology. It was created with security and sustainability in mind, making it a popular choice for people seeking a greener alternative to conventional cryptocurrency networks. However, like all cryptocurrencies, its value is subject to fluctuations due to a variety of factors, including market demand and world events.

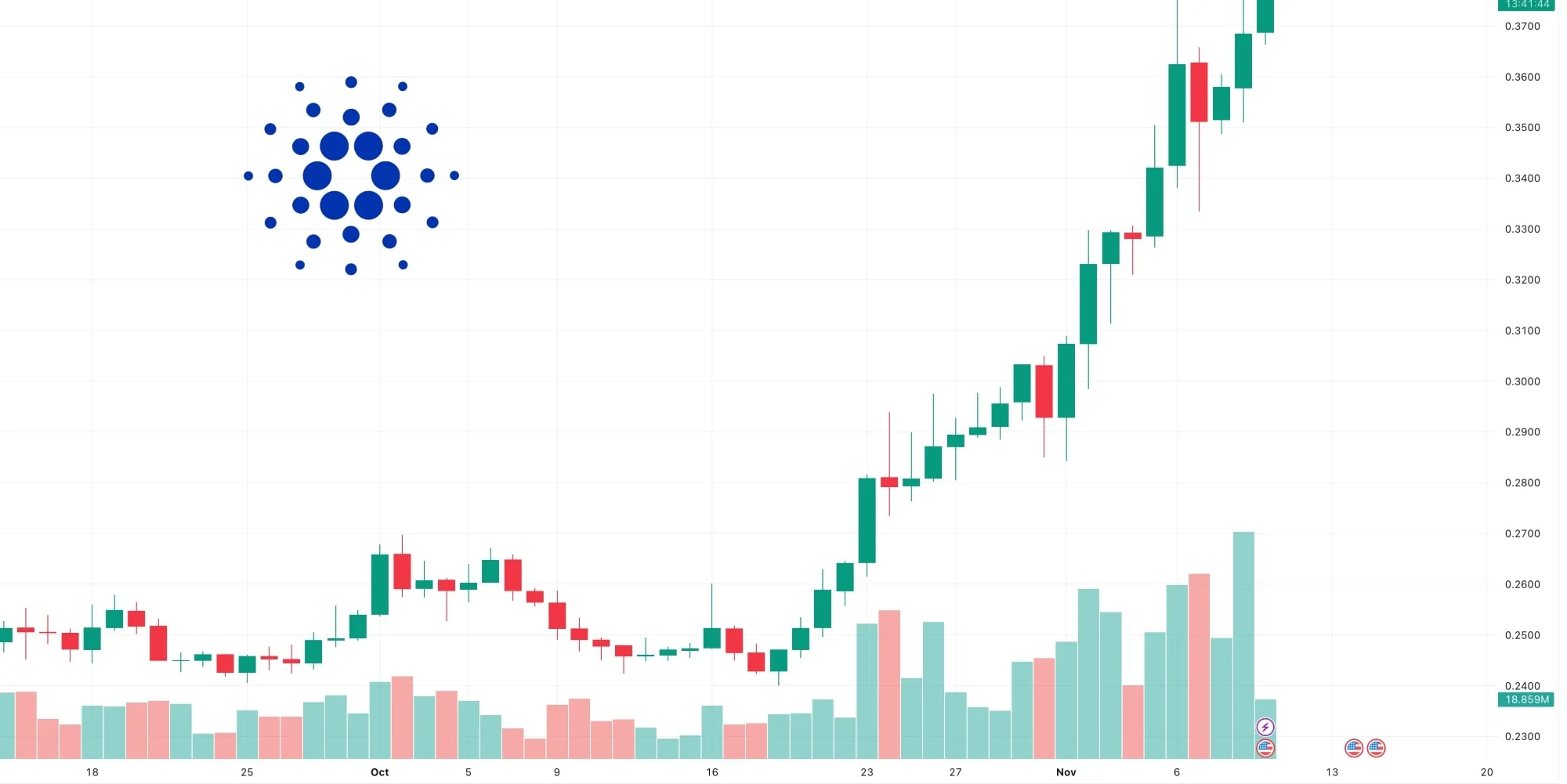

You can learn a lot about Cardano’s prospects in the future by monitoring its price. Knowing how ADA’s price fluctuates is essential to make better judgments in the ever evolving cryptocurrency market, regardless of whether you’re considering purchasing it or are simply interested in its current status.

1. Understanding Cardano and Its Price Movements

Cardano (ADA) is a blockchain platform designed to be secure, scalable, and sustainable, separating itself from others with its proof-of-stake consensus method. Investors who care about the environment will find this innovative method appealing because it uses less energy. However, like all cryptocurrencies, ADA’s price is affected by a variety of factors, including market sentiment and technological advancements.

Unlike conventional equities, Cardano’s price doesn’t follow a predictable pattern. It is greatly impacted by investor opinion, the general trends in the cryptocurrency market, and advancements in Cardano’s technology, including improvements to its smart contract capabilities. For instance, the market reacted with greater interest when Cardano successfully implemented the Alonzo upgrade, which raised its price.

However, larger patterns in the cryptocurrency market are also linked to changes in Cardano’s price. Although its percentage gains or losses may differ, ADA frequently follows Bitcoin or Ethereum’s price spikes and crashes. To better forecast Cardano’s price changes, traders and investors must monitor developments in the Cardano ecosystem as well as worldwide market circumstances.

2. Factors That Influence Cardano’s Price

A variety of internal and external factors affect Cardano’s price, just like they do for any other cryptocurrency. The evolution of the Cardano blockchain itself is important since every new feature or update has the potential to raise demand for ADA coins. The value of ADA increased, for instance, when Cardano’s smart contract capabilities were made available with the Alonzo hard fork, opening the way for decentralized financial (DeFi) applications.

The price of Cardano is also influenced by outside variables including macroeconomic trends and regulatory news. In large markets like the U.S. or Europe, regulatory uncertainty can lead to volatility as investors respond to possible changes in the law. For example, news of government crackdowns against cryptocurrency trading platforms might cause steep drops in prices for all of them, including Cardano.

Additionally, market perception regarding innovation and uptake affects Cardano’s price. As blockchain technology advances, investors frequently search for the next promising idea. As Ethereum profited from its early adoption of decentralized applications (dApps), Cardano may raise the price of ADA if it maintains its strong community and draws developers to its ecosystem.

3. How Market Sentiment Affects Cardano’s Price

One of the strongest factors influencing Cardano’s price is market sentiment. A large portion of the volatility of cryptocurrencies can be ascribed to the mood of investors at any given time regarding the market. The price of ADA may rise in response to good news or enthusiasm about Cardano’s technological developments, or it may fall in response to a widespread feeling of caution or fear in the larger market.

For instance, the market frequently responds favorably to announcements made by Cardano founder Charles Hoskinson regarding significant partnerships or improvements, which raises the price of ADA. Conversely, news or speculations regarding security flaws, sluggish adoption, or a lack of noteworthy advancements may incite pessimism and drive down the price.

Cardano’s price fluctuations are significantly influenced by the general state of the cryptocurrency market, particularly developments with Bitcoin and other big coins. Market bullishness, which is fueled by investor optimism, has the potential to sharply increase Cardano’s price. On the other hand, bearish tendencies can drive down prices generally and are frequently brought on by market corrections or outside variables like increases in interest rates.

4. The Role of Cardano’s Ecosystem in Price Changes

The ecosystem of Cardano is made to offer a scalable and sustainable blockchain for a variety of decentralized applications, such as supply chain management and banking. The price of ADA is directly impacted by the expansion of this ecosystem, which in turn affects the demand for the cryptocurrency. The value of ADA is anticipated to increase as additional projects expand upon Cardano, demonstrating the network’s growing usefulness.

Cardano’s ecosystem places a lot of emphasis on decentralized finance (DeFi). DeFi applications, which enable users to borrow, lend, and trade assets without depending on conventional financial institutions, were made possible by Cardano’s introduction of smart contracts. The price of ADA may increase as a result of these platforms’ success, particularly if Cardano gains a sizable portion of the DeFi market.

Furthermore, Cardano’s value may be significantly impacted by collaborations with other initiatives or sectors. For example, the price of ADA may skyrocket if Cardano emerges as the preferred blockchain for large corporations or governments looking for decentralized solutions. The more Cardano demonstrates its practical value, the more probable it is that its price will rise in line with its increasing significance.

5. The Future Outlook for Cardano’s Price

Given the unpredictability of cryptocurrencies, it is difficult to forecast Cardano’s future price. Nonetheless, a number of indicators suggest that ADA may have a bright future. Cardano’s price may increase steadily over time if it keeps creating a strong ecosystem with more practical uses and strong developer support.

One thing to think about is how Cardano’s scalability is still evolving. The network may establish itself as a significant force in the blockchain market and raise ADA’s value if it can process transactions more effectively and economically. Additionally, as more individuals and organizations embrace the blockchain, Cardano’s price may increase if it becomes popular in developing nations with less developed traditional financial systems.

But like all cryptocurrencies, Cardano’s value is influenced by outside market factors and volatility. A slowdown in uptake, technical difficulties, or regulatory changes could all have a detrimental impact on the cost. Despite this uncertainty, Cardano is one of the more intriguing initiatives in the cryptocurrency market because of its emphasis on sustainability, innovation, and real-world use cases.